Autumn 2022

Deepening European energy crisis

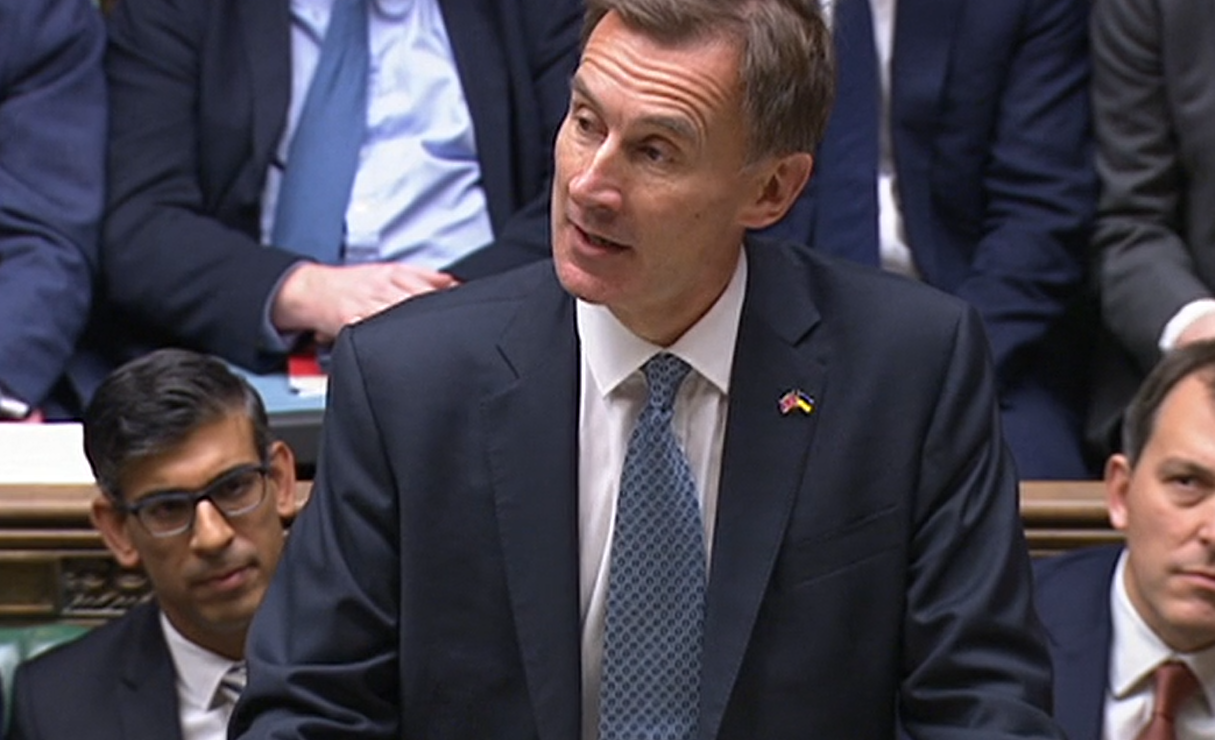

On Thursday 17th November 2022, the current Chancellor of the Exchequer, Jeremy Hunt, presented the Autumn Statement to Parliament. After presenting the statement, the Office for Budget Responsibility (OBR) published,their much awaited, updated forecasts, that had previously been conspicuous by their absence. This follows a turbulent time in UK politics with market volatility.

There have been three Chancellors since August 2022, and three Prime Ministers, with the previous Chancellor, Rishi Sunak, eventually becoming the UK’s Prime Minister.

A statement dubbed a ‘mini-budget’, given by the Truss’ administration upon replacing Johnson’s Government, was largely reversed in an ‘un-budget’ of mid-October that sought to preserve the credibility of UK governance, in the eyes of international debt markets. Indeed, this was acknowledged by the current Chancellor, in saying that “credibility cannot be taken for granted”.

These three successive Governments have delivered five major fiscal statements for the UK since the March ’22 Spring Statement:

• Chancellor Sunak’s May 2022 cost-of-living package, adding £9 billion to annual borrowing, with savings in subsequent years from a new tax: an energy profits levy.

• Prime Minister Liz Truss’s September 2022 uncapped energy price guarantee to consumers, adding £70 billion to debt, in the view of the OBR.

• Chancellor Kwarteng’s personal and corporate tax revisions would have then added another £48 billion to annual borrowing over the medium term.

• Yet almost all of his tax changes were reversed in the un-budget of 17 October 2022.

• This latest package of net tax rises and (later) spending cuts now seek to reduce annual borrowing by £62 billion in five years’ time, 2027-28.

European energy crisis

Russia’s invasion of Ukraine has precipitated a European energy crisis which is, the OBR say, the most important economic development causing fall-out, in fiscal terms, and gyrations in UK fiscal policy. For a net energy importer like the UK, the extraordinary increase in gas prices represents a terms-of-trade shock that leaves the UK poorer: a basic necessity becoming more expensive.

While policy may alter who in the UK pays for these higher energy costs, within and between generations, by borrowing, Government is unable to eliminate the issue.

The backdrop to the last six months is a global economy recovering from the pandemic and an intensification of energy and food supply shocks coming from the curtailment, by the West, of Russian imports. European wholesale gas prices rose by ten-times and are now expected to remain four times higher than their pre-pandemic level. Between January 2010 and December 2019, one-month ahead forward prices for gas averaged 50p a therm. Market expectation for gas prices in August have been volatile, with prices for the first quarter of 2023 having been as high as £8.70 a therm and as low as £3.20.

Gross Domestic Product – forecast output 2023

The effect of Government’s protection of consumers (approximately £100 billion over two years) means near-term changes in gas prices will increase public debt. This ultimately smooths the transition for consumers to much higher energy prices. There remains a 2% reduction in output (GDP), the OBR foresee, from peak to trough, but GDP would have fallen more, perhaps by another 1%, without Government intervention. The fall in GDP is principally derived from a fall in consumption.

Living standards and inflation

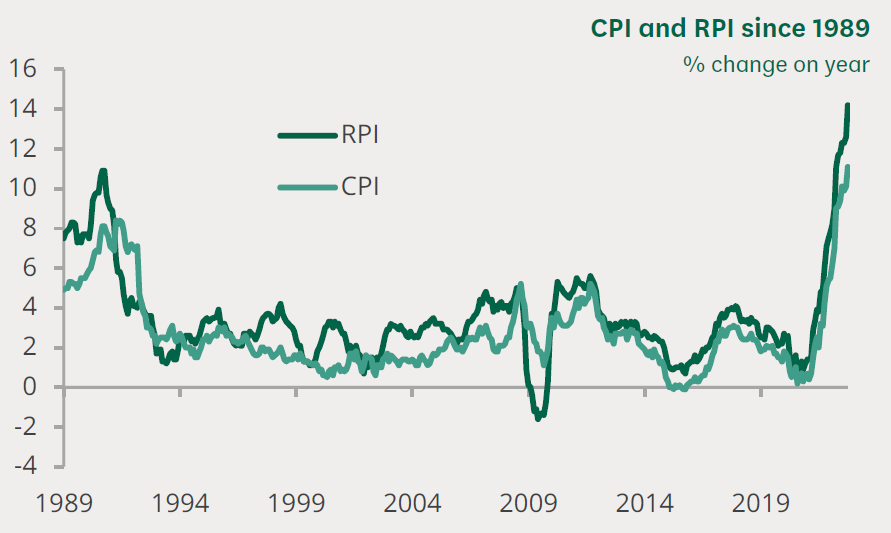

Consumer prices, as measured by the Consumer Prices Index (CPI), were 11.1% higher in October 2022 than a year before. The OBR expect inflation to peak at this 40-year high. The OBR say that this peak would have been even higher at nearly 14 per cent without amelioration of the energy price shock.

The speed of change of inflation since February 2021 is remarkable. October 2020 saw CPI at less than 1%. The level now, the expected peak, is over 2% beyond the level the OBR considered might be the highest expected point at the time of their March report. RPI is running at 14.2%.

Clearly in the near term, as the OBR say, inflation far outpaces the growth of wages leaving the real level of disposable incomes cumulatively 7% lower over the next two years. The UK has rarely had two consecutive years of falling living standards. If the OBR are right, this would be only the third time since the mid-1950s that the statistical measurement of living standards has fallen for two consecutive fiscal years. The last time being in the aftermath of the global financial crisis and before that in the mid-1970s (1975-76 and 1976-77).

The OBR expect households that are able to draw on their savings to cushion the impact of higher prices on their consumption. This optimistic expectation of behaviour represents a key difference of opinion with the Bank of England’s forecast.

Potential output of the UK economy

A year of mildly declining output will however open a degree of spare capacity within the UK economy. In the view of the OBR there have been several largely offsetting developments: continuing high levels of migration; and, owing to higher energy pricing, lower business investment and productivity. All in all, that leaves their assessment of the rate of growth in potential output in five years’ time, unchanged at 1¾ per cent a year.

The OBR had assumed that post-Brexit net migration would be below the pre-Brexit level (by 100,000 plus) but now their forecast is set for annual inward net migration to be over 200,000 people a year.

Higher migration compensates for levels of inactivity in the UK working population. In September 2022, there were 9 million people in the UK who were economically inactive (not in work and not actively looking for work), around a fifth of the working age population according to ONS and 553,000 above pre-pandemic levels. Long term sickness is a significant feature and possibly a legacy of the pandemic and at over 2.5 million is at the highest recorded level since comparable records began.

In contrast the ONS records a further fall in unemployment in the period and also a fall in employment, despite there being 1.23 million vacancies (429,000 higher than pre-pandemic). There were a higher number of vacancies in this period than the ONS statistic for those unemployed. This means that there was a further rise in inactivity and inactivity levels remain well above pre-pandemic levels.

Fiscal outlook

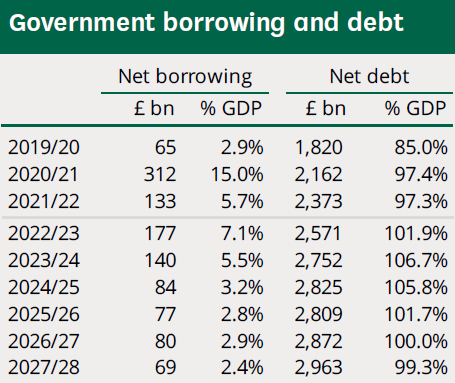

Government borrowing has fallen from the post-war peak of 15 per cent of GDP at the height of the pandemic to below 6 per cent of GDP last year. The OBR forecast public sector net borrowing (PSNB) to rise sharply from £133 billion (5.7 per cent of GDP in 2021-22) to £177 billion (7.1 per cent of GDP in 2022-23). This is mainly owing to the cost of support to energy consumers and higher debt interest spending. Underlying forecast changes (the direct and indirect effect) add on average, each year, £55 billion to annual borrowing in each of the next five years – three quarters of which is owing to higher debt interest.

Forecast of borrowing and debt is revised upward even though tax revenues rise from 33 per cent of GDP pre-pandemic to 37 per cent. The tightening of spending is effectively delayed until after the next general election (that must take place no later than January 2025) by means of apparent future spending cuts on unprotected departmental spending budgets (minus 0.7% GDP - in real terms).

The scale of recent borrowing helps to explain why the totality of the stock of Government debt has risen from 36 per cent of GDP in scale in 2007-08 to 102 per cent of GDP today (2022).

The headline measure of public sector net debt is forecast to rise in this coming year to a prospective 64-year peak of 107 per cent. The impact of the energy price shock on Government debt raises debt in the near term by around 2½ percent of GDP. The level of the totality of debt is forecast to stabilise to a degree after the next general election. Although not likely returning below 100 percent of GDP.

In fact, Government debt (including the Bank of England) having been less than £2 trillion before the coronavirus pandemic is now well on the way to being around £3 trillion by the end of the forecast period (2027-28), despite the OBR’s optimism in comparison to the Bank’s.

This much higher stock of debt, coupled with much higher interest rates, means that the share of revenue being consumed by interest payments has risen dramatically since the Spring, as global interest rates have risen in response to rising inflation. The OBR expect debt interest spending to more than double from £56 billion (2021-22 outturn) to cost £120 billion this year 2022-23. The highest amount as a share of revenue (12 per cent) since immediately following the Second World War.

Monetary outlook

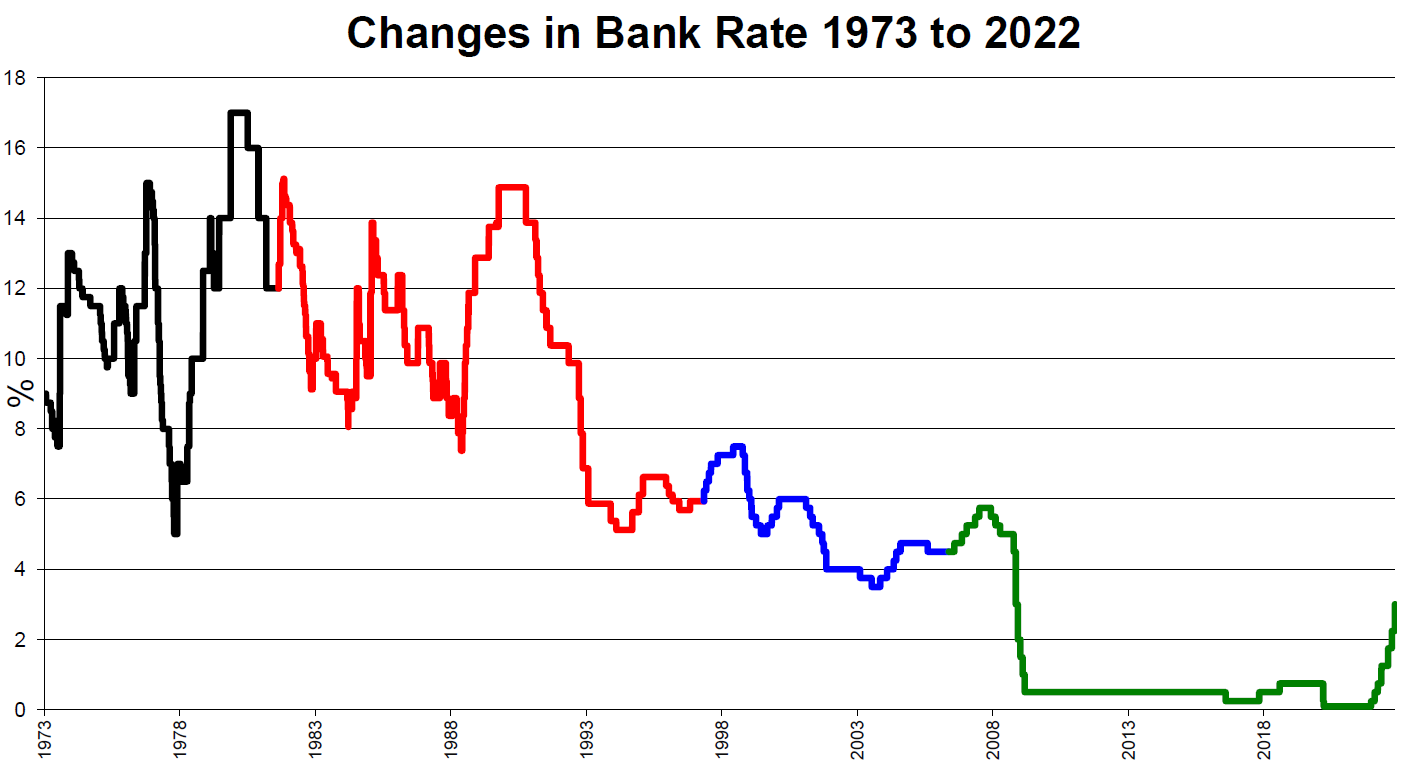

Owing to the rise of inflation, real yields on 20-year inflation-linked gilts have risen since the March forecast from minus 2.3 per cent, when investors were in effect paying to hold Government bonds, to plus 0.2 per cent. With this we appear to be ending an era of cheap money and ultra-low interest rates. Gilt yields have now fallen back from the market convulsions following the announcement of the mini-budget.

In relation to questioning monetary policy, the Bank’s former Governor Mervyn King has pointed out that with private sector wage inflation of 6.5% ‘… a 3% Bank Rate does not seem likely to be enough to bring inflation back down to 2%.’ The current Governor continues to argue that inflation’s onset has been ‘transitory’ in nature, based on the Bank’s modelling of the economy; incapable of predicting idiosyncratic events such as the shock emanating from the Russia-Ukraine situation.

In forming policy, ex-Governor King says that ‘central banks really lost touch’ when they broke ‘that intellectual link between inflation and what was actually going on’ within the British economy: ‘…the models they use have the property, that whatever you do to monetary policy, inflation always comes back to the target because it has to.’ Because it is ‘…the assumption that closes the model.’

An intellectual argument about the circularity of groupthink perhaps, but one with real world consequences.

Anthony Denny

9 December 2022