Autumn 2023

UK economy proves resilient to pandemic and energy crisis

On On Wednesday 22nd November 2023, the Chancellor of the Exchequer, Jeremy Hunt, presented his Autumn Statement to Parliament and the Office for Budget Responsibility (OBR) published their updated forecasts.

There is considerable uncertainty around this forecast in part reflecting, the OBR say, the ‘volatile external environment’, arising notably from the ongoing Russian invasion of Ukraine and conflict in the Middle East.

However, the composition of nominal GDP growth over the forecast is expected to be more ‘tax-rich’, with stronger nominal wage growth, consumption, and profits, resulting in an expected sharp rise in the tax burden in 2024-25, driven mainly by income tax - income tax thresholds remaining frozen - and corporation tax; as the full-year impact of the higher main rate of corporate tax, increasing from 19% to 25%, from April ’23, takes effect.

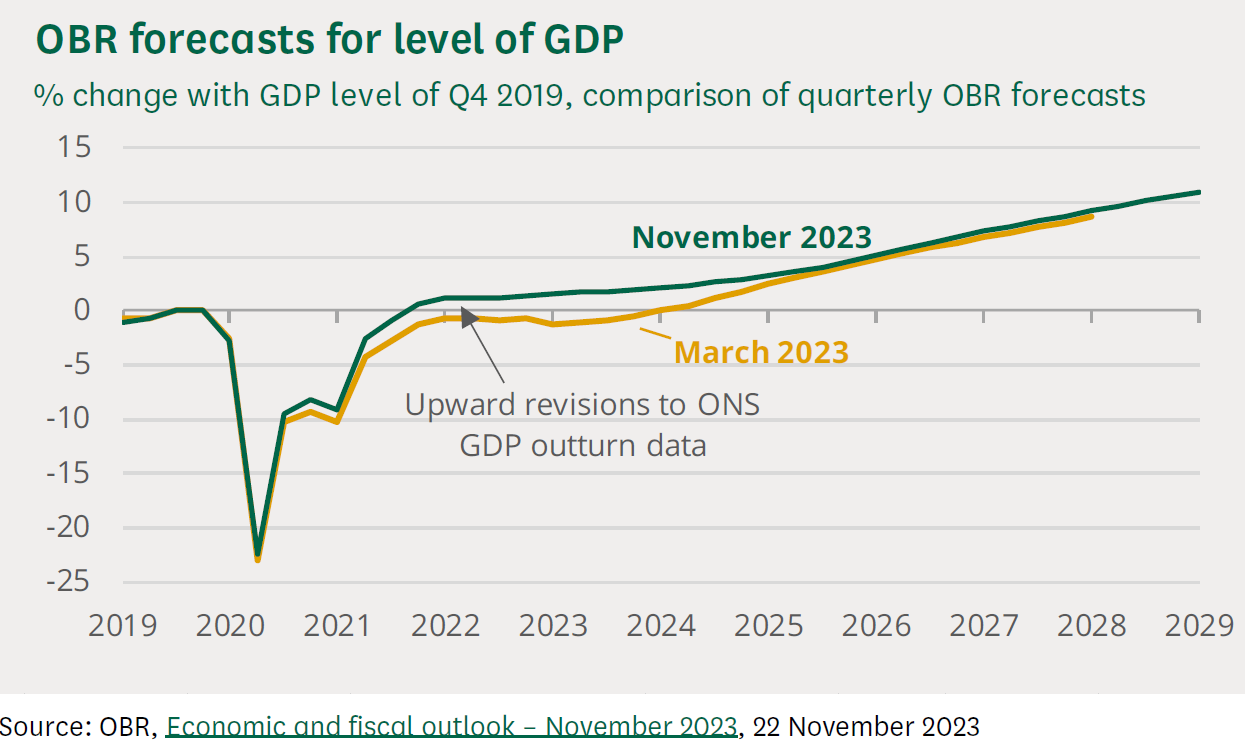

The UK economy has recovered more fully from the pandemic and weathered the energy price shock, arising from Russia’s invasion, better than the OBR had anticipated.

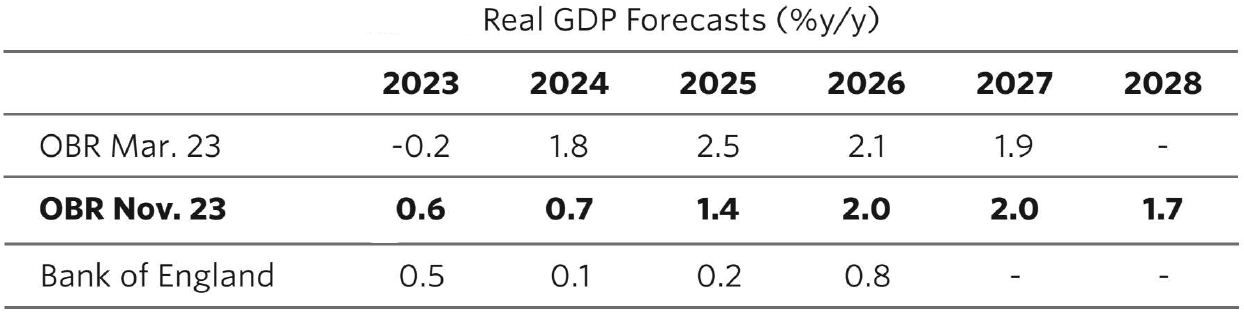

Forecast economic output – Gross Domestic Product

ONS statistical revisions now show that the UK economy recovered to the pre-pandemic level at the end of 2021. Indeed, the size of the UK economy was apparently nearly 2 per cent above that pre-pandemic level in mid-2023, rather than around 1 per cent below, as had been believed by the OBR in the Spring. Leading the OBR to say that the economy has proven more resilient. Stronger indeed, than the OBR had expected, in the face of significantly higher energy prices, inflation, and interest rates; GDP being almost 3% higher than they thought in March and beyond the 2024 return to pre-pandemic level of output.

Taken together, their autumn forecast and revisions in ONS historical data, leaves the level of expected nominal GDP, 5.3 per cent higher in 2027-28 than previously forecast. This substantial revision, they say survey data suggests, is attributable to ‘a modest degree of excess demand, rather than the excess supply’ they had anticipated as being present in the UK economy, in March.

Therefore, on this basis, but from a higher starting point, the OBR expect the UK economy to grow more slowly over the coming period of the forecast.

Nevertheless, despite their muting of future expectations for the UK economy (and global economy), the OBR is not forecasting a UK recession. Whereas last year, from the third quarter of 2022, one had been imminently expected, and to last just over a year. (An expected, peak to trough fall of 2% in GDP, a recession lasting five quarters, in the wake of the energy price shock).

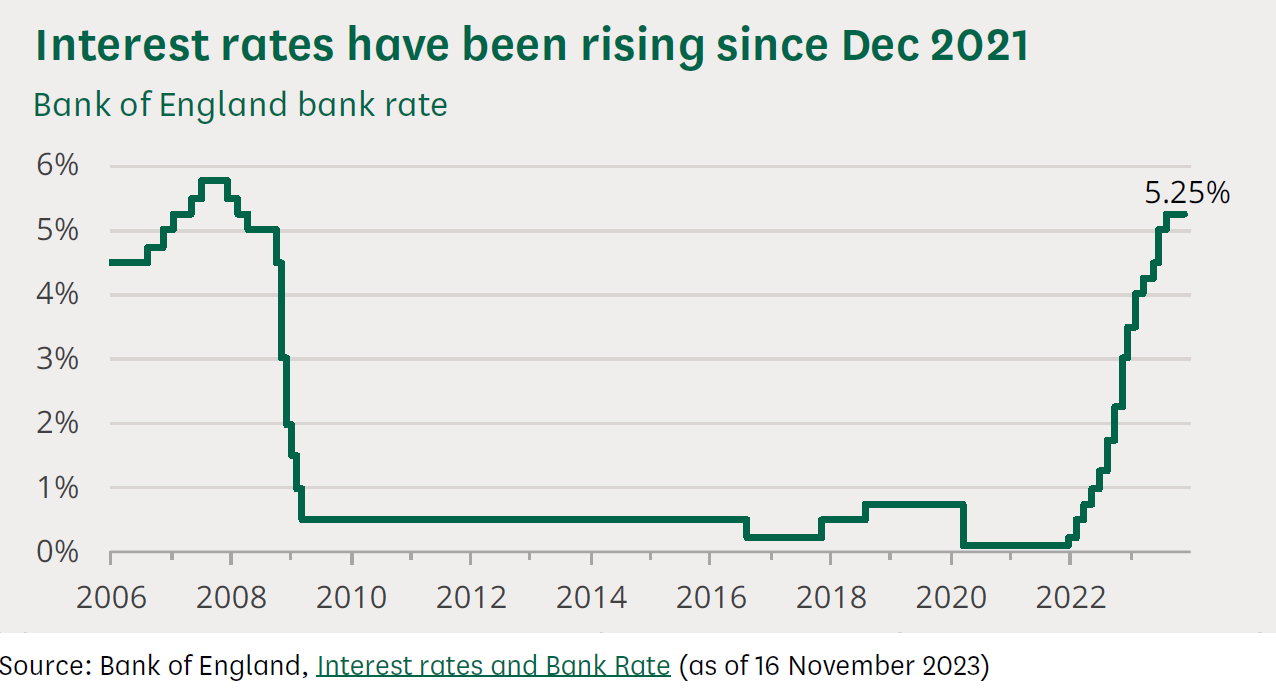

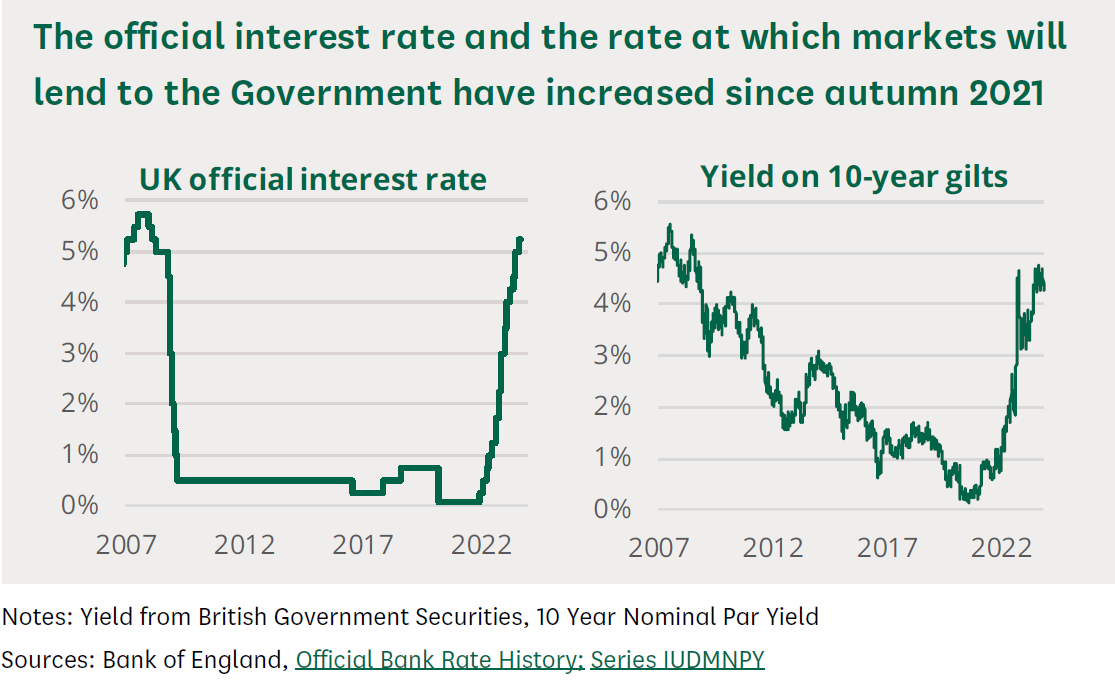

A key development since the Spring has been the further rise of UK and global interest rates. Interest rates are now over one percentage point higher than the OBR had expected in March. Bank Rate reached a 15-year high of 5.25 per cent in August 2023 and markets now expect Bank Rate to peak at just over 5%.

Some of the downward revision to future expectations of UK economic output are owing to the OBR believing higher interest rates are likely for longer.

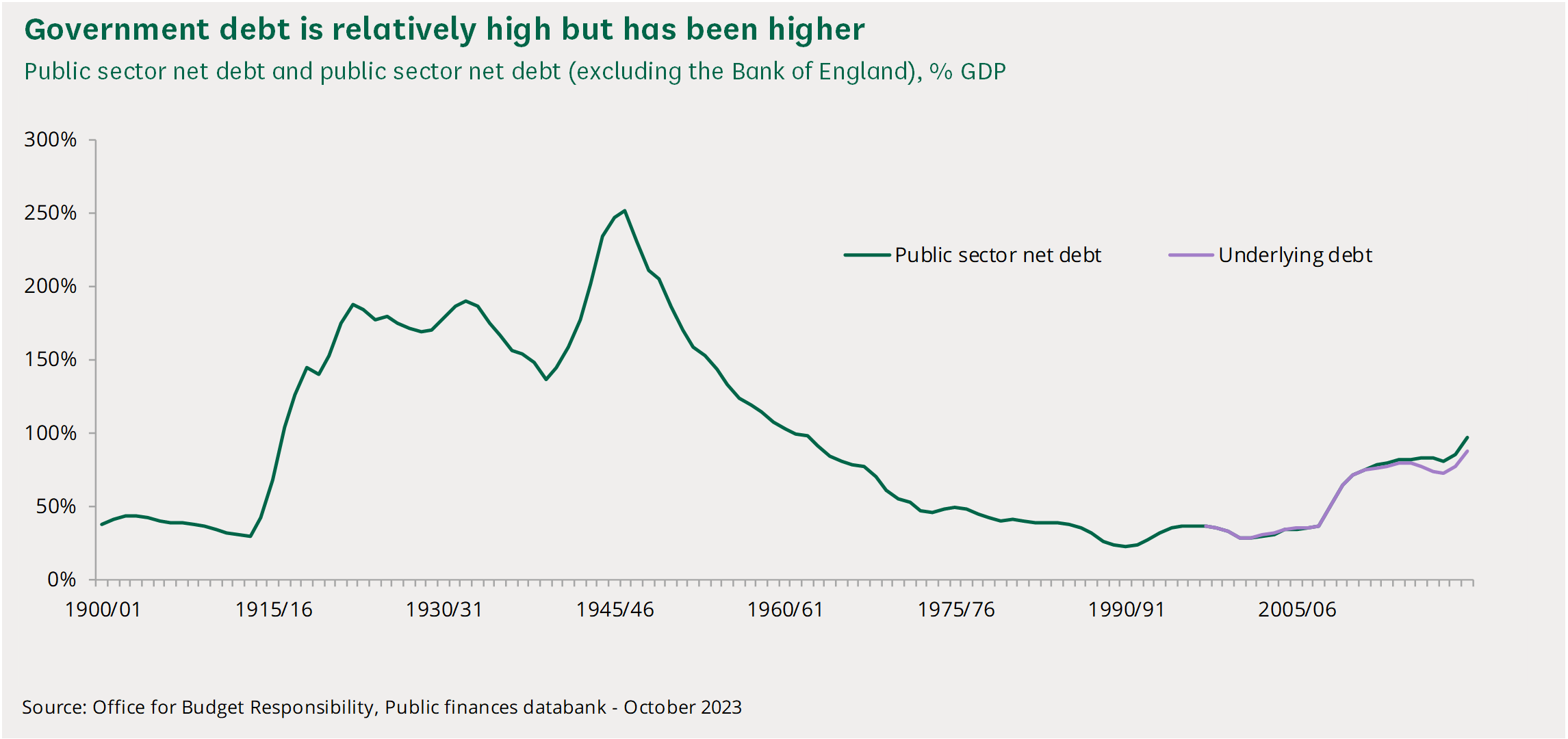

Public Finances

The economic forecasts the OBR have produced, showing a rosier outlook for public finances, arising from buoyant tax receipts, stronger wage growth and higher nominal output, has allowed the Chancellor some giveaways. Rather than holding a reserve, by cutting government borrowing faster, the Chancellor spent around three-quarters of the increase in forecast headroom. Leaving a buffer of a mere £13 billion against his main fiscal rule. Though, there is a bigger margin against his second fiscal rule: that annual borrowing must not exceed 3% of GDP (£61 billion).

There was much speculation in the run up to the event for ‘tax-cuts’. Crucially, the OBR’s prediction for debt (as a percentage of GDP) to fall in 2028-29, with pre-measures headroom of £31 billion, gave the green light. The Chancellor spent £18 billion of this, including a 2% reduction of the National Insurance main rate for employees from 12% to 10%, taking effect from 6th January 2024. There was also the abolition of Class 2 National Insurance for the self-employed and 1% cut in Class 4 NICs.

These cuts will cost about £10 billion a year but will the £343 (in ‘take-home pay’, the OBR calculate) a year on average, for each worker, be a vote winner for Conservatives in a 2024 General Election?

The Chancellor also made permanent an extension to the corporation tax programme of up-front capital expenditure write-off for tax purposes.

Potential output of the UK economy

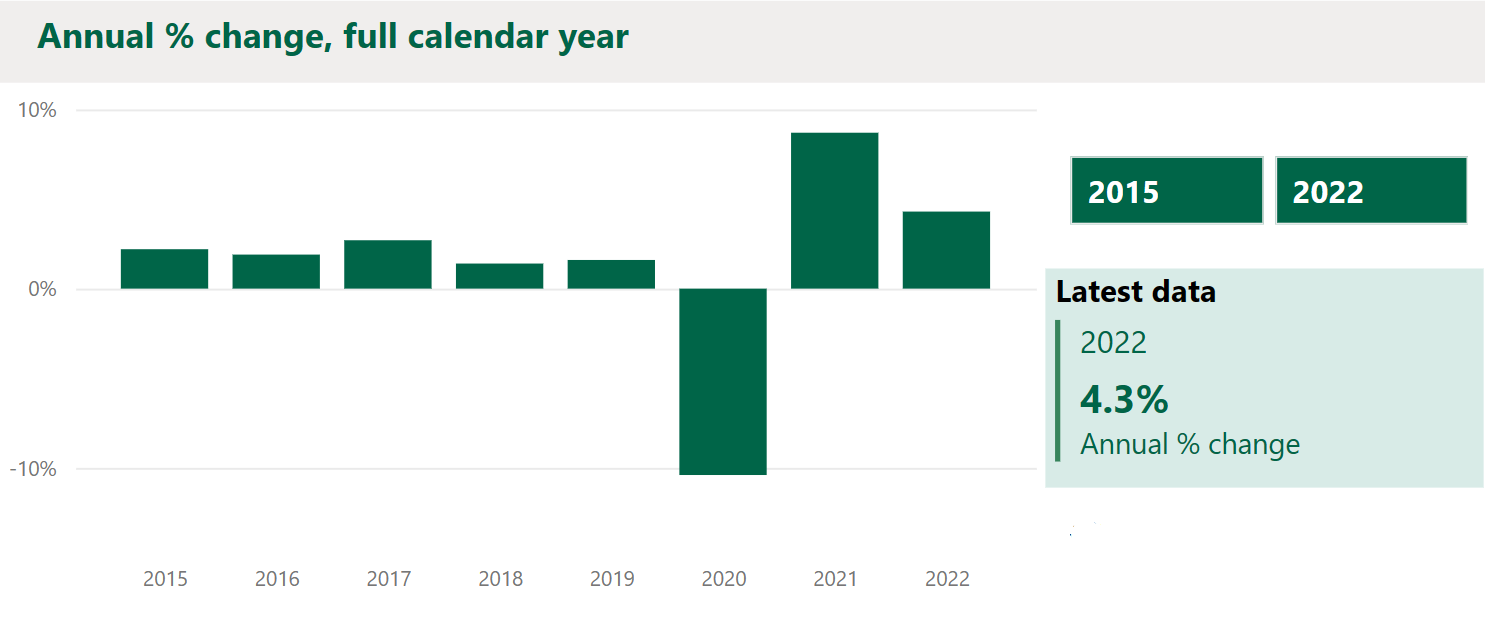

In the OBR’s central forecast, they have revised down their estimate of the medium-term potential growth rate of the UK economy to 1.6 per cent, from 1.8 per cent in March. The revision is largely driven by a weaker forecast for average working hours per worker, which the OBR now expect to fall, rather than holding flat, and to largely reflect a reassessment of the effect of demographic changes to the composition of the working population toward younger and older age groups who work shorter hours on average.

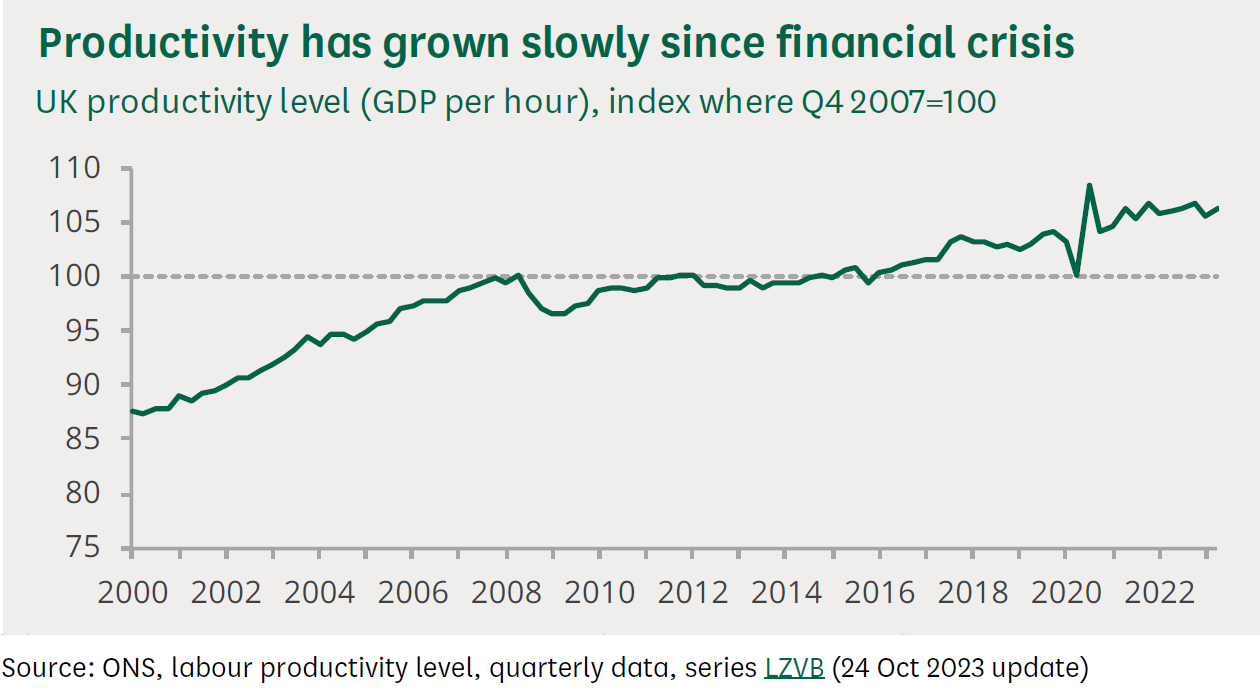

Poorer productivity growth in the UK economy, after the 2008-09 financial crisis, remains a continuing issue. The OBR believe the impact of these downward revisions on the medium-term level of GDP are only partly offset by higher migration, stronger business investment, lower energy prices, and the various policy measures announced to boost labour supply and business investment.

Although overall the Chancellor’s announcements bring a ‘modest improvement’ the OBR say, to the supply side of the UK economy, interestingly the biggest increase in potential output comes from the cut in National Insurance Contribution rates which is estimated to raise employment by 28,000 people and total hours worked by 94,000 in full-term employment by raising the post-tax gains from work.

Accordingly, real GDP per person, a measure of productivity in the UK economy, the OBR say, remains more than ½ per cent below the pre-pandemic peak and may only recover that peak at the start of 2025.

Weak economic growth, despite much higher levels of lawful net migration (reaching annually an ONS revised 2022 statistic of nearly three quarters of a million people - compared to around 220,000 in 2019, pre-pandemic), means that real GDP per person is expected to continue to fall in the second half of this year, 2023. The OBR believe that GDP growth should pick-up, while net migration falls back towards their assumed long-run level of around quarter of a million annually by the end of the forecast period. The decline in migration they consider will be partly owing to tighter restrictions on international students bringing their dependants and increasing immigration fee-costs.

Living standards and inflation

Market expectations for natural gas prices have fallen now, and in the medium term, since the Spring. The OBR’s forecast is based on wholesale gas prices averaging £1.20 per therm in 2024 and 2025; 40 and 20 pence a therm lower respectively. The quarterly peak last year was £3.50 a therm. Yet, the OBR continue to believe that gas prices in future will be twice their pre-pandemic average of 50 pence per therm.

The recent fall in prices reflects a rapid rise in liquified natural gas imports from the US and Qatar, compensating for the loss of Russian supplies and allowing European countries to fill their gas reserves. Even so, despite recent relative stability in the gas futures market, the OBR continue to identify supply disruption or a severe cold winter, as key risks to gas pricing.

Consumer Prices

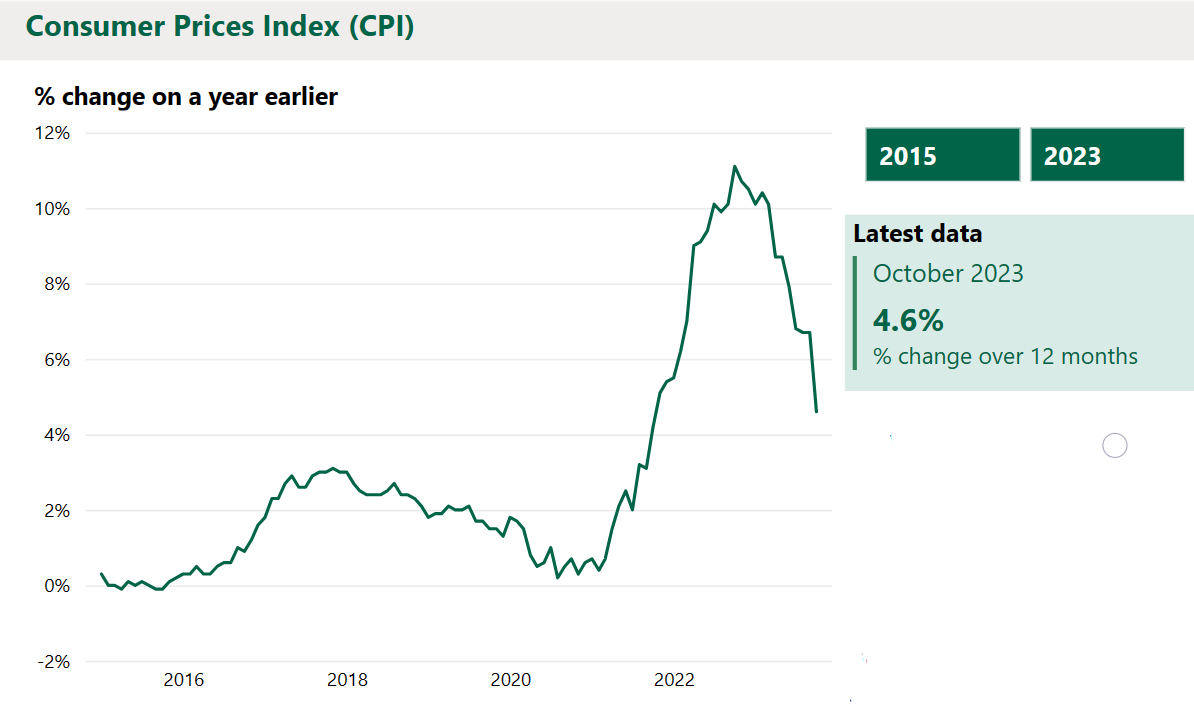

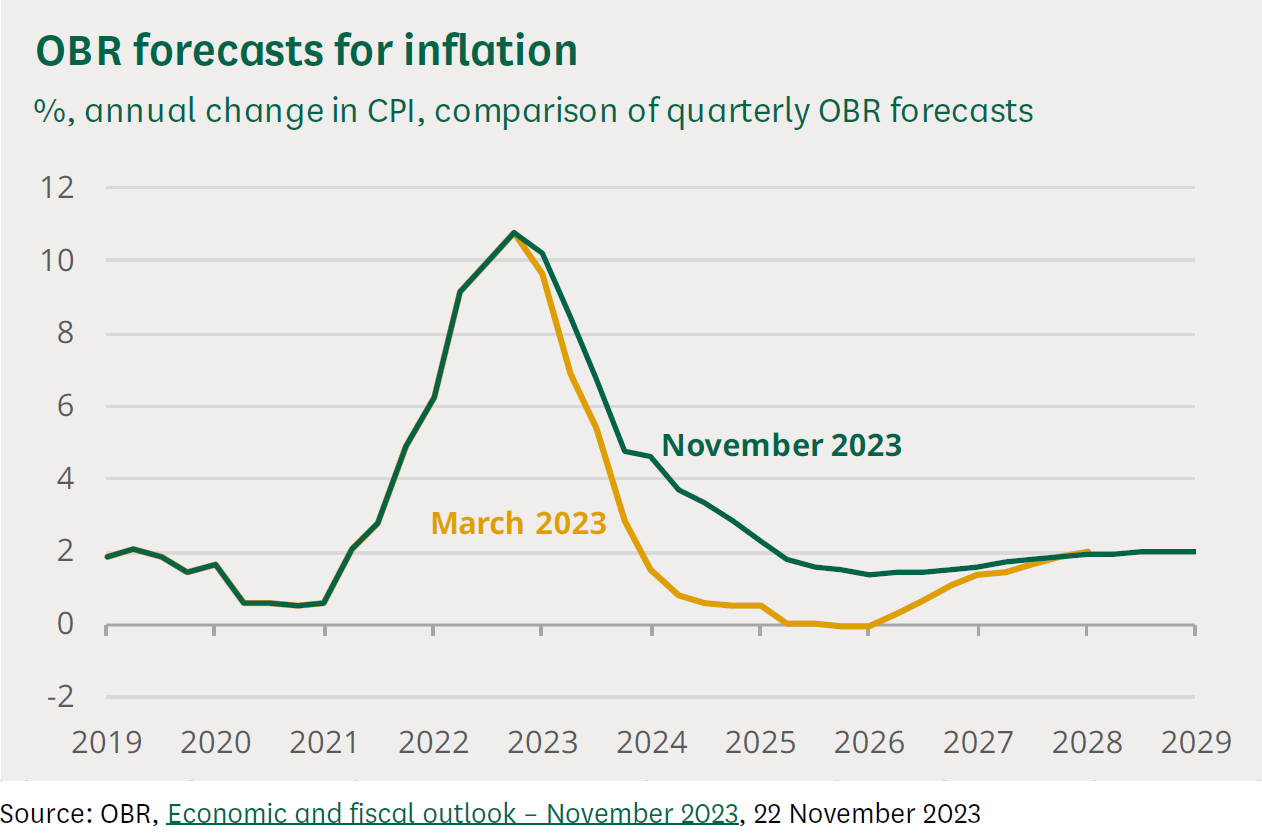

The OBR correctly predicted last autumn that the rate of increase in consumer prices would peak at a 40-year high. As measured by the Consumer Prices Index (CPI), this measure peaked at just over 11 per cent in October 2022 (the highest rate recorded for increasing inflation, since the data series began in 1997). CPI would have been nearly 14 per cent, they estimated, but for Government intervention and amelioration of the energy price shock.

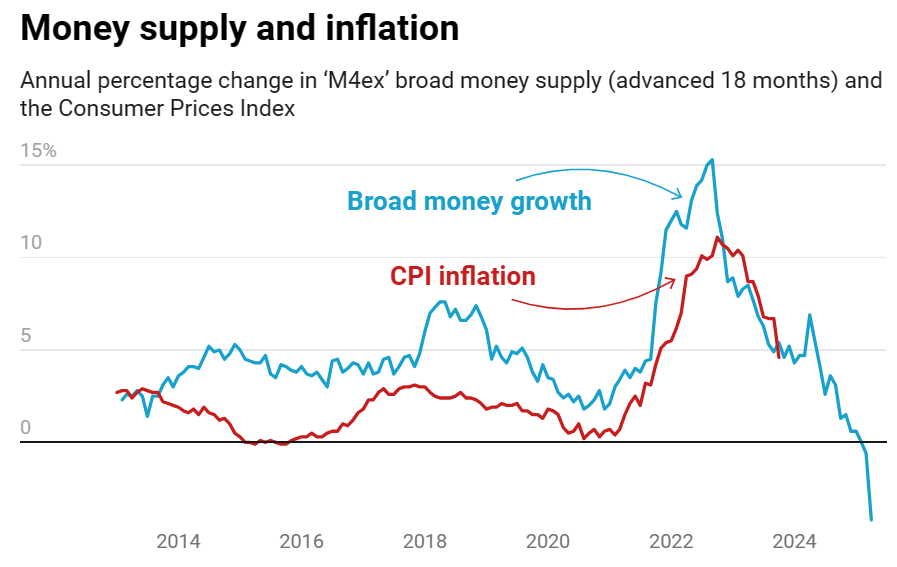

In another key development during this year, because the OBR consider there has been a modest degree of excess demand, rather than excess supply, in the UK economy, they now expect inflation to remain higher for longer, being more domestically fuelled, through stronger nominal wage growth, more than offsetting the faster-than-expected decline in gas prices.

UK earnings growth reached just over 8% in the second quarter of 2023 and ranged between 6% and 8% in the third quarter, according to official statistics, driven by strong private and public sector pay growth.

From last year’s peak CPI, inflation is now expected by the OBR to be just below 5% in the final quarter of 2023. With higher persistent inflation comes market expectations for interest rates to be greater for longer than the OBR previously had assumed.

Global economic conditions have deteriorated since the Spring. Energy and food markets have faced continued disruption owing to Russia’s invasion of Ukraine, while monetary supply has been tightened globally to control inflation. Accordingly, the OBR and IMF expect GDP growth, in advanced economies, to slow this year and next, and no longer expect, in their medium-term outlook for world GDP, a return to the pre-pandemic trend.

World trade forecasts are consequently lower, with conflict in the Middle East posing an ongoing risk to the global outlook, although, the OBR say, commodity prices have so far ‘responded little to this threat’.

Since the OBR’s March forecast, expectations of Brent crude oil prices for 2024 have increased by over 8% to $82 a barrel, amid production cuts by OPEC+ members, including Russia. The price of crude oil has been volatile in recent months, peaking at $97 dollars a barrel (27 September). A higher oil price is a key risk to the forecast economic outcome, given the ongoing conflict in the Middle East. The OBR understatedly make the point that a sustained period of higher oil prices would raise inflation and reduce consumption and productivity.

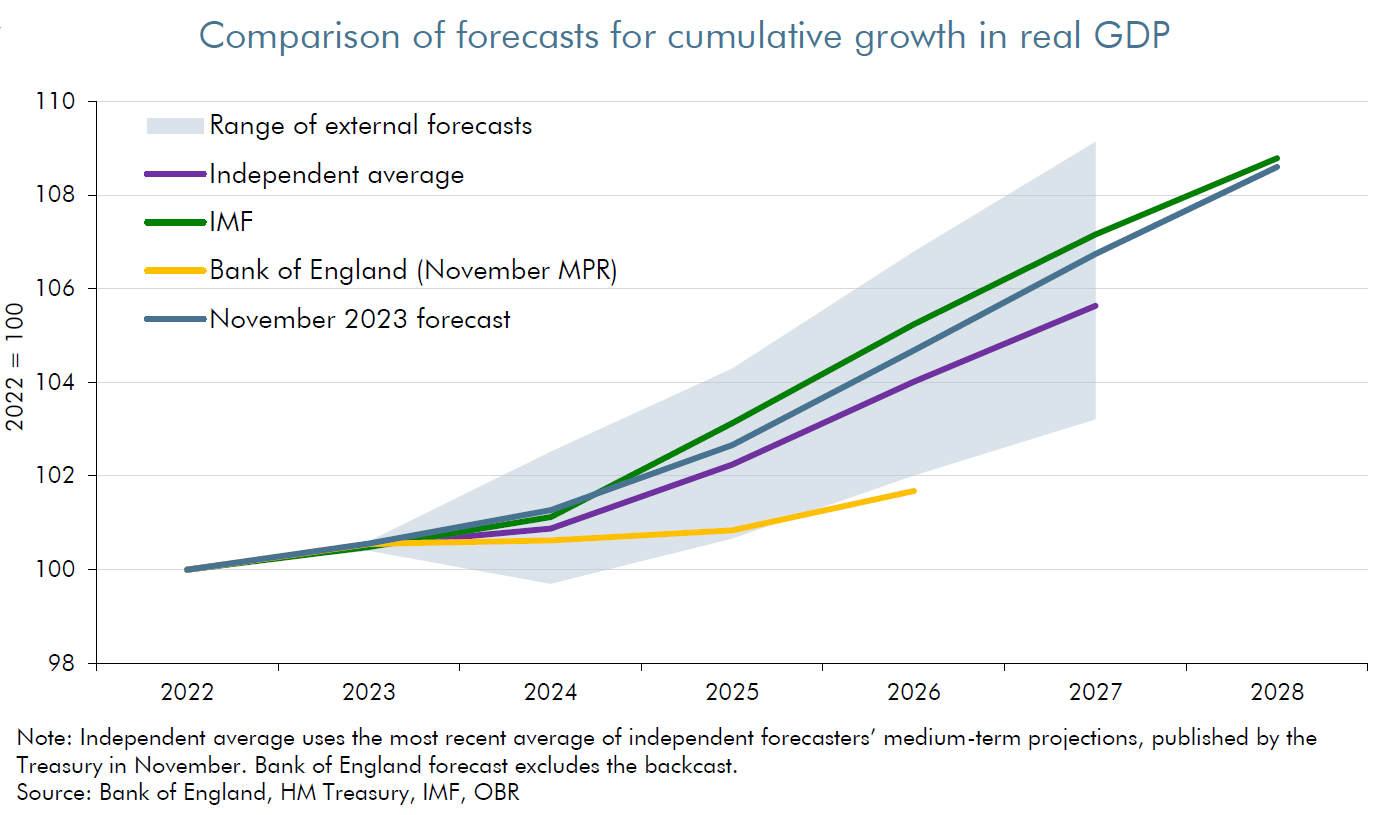

Given this backdrop, the OBR forecast for cumulative real GDP growth from 2023 to 2027 is perhaps unexpectedly higher than an average of independent forecasters (by around 1 percentage point), but less significantly, lower than that of the IMF.

The Bank of England’s forecasters expect much lower medium-term growth in the UK economy than the OBR (by a significant level of output - more than 3 percentage points lower). The OBR’s difference of opinion with the Bank is principally owing to a pessimistic assumption of UK productivity growth, they also expect spare capacity, or slack, owing to weak demand, and some (small) variations in their assumptions for market prices:

Yields on UK government debt are over 1 percentage higher across the yield-curve and now have reached 5% on some long-dated maturities, for the first time since 2002.

With the stock of debt approaching £3 trillion (projected) this rise in the cost of debt servicing will have significant implications for a future government trying to balance spending demands with taxation.

Anthony Denny

30 November 2023