Spring 2021

UK economy set to rebound - following rapid vaccine rollout

On Wednesday 3rd March 2021 the Chancellor, Rishi Sunak, presented to Parliament the 2021 Budget and the Office for Budget Responsibility published their latest set of forecasts for the economy and public finances.

At the March 2020 Budget, the Chancellor set a spending ‘envelope’ for a Comprehensive Spending Review, covering the period until 2024/25. Although this was abandoned, with the pandemic creating uncertainty affecting long term planning. The November 2020 review then covered only the year ahead, 2021/22, meaning departments have plans to March 2022. This Budget has similarly announced another annual review.

Since last November’s OBR statement, in the UK there has been a resurgence of infections over the winter, with around 1 in 5 people contracting coronavirus, 1 in 150 being hospitalised, and 1 in 550 dying, the fourth highest mortality rate in the world.

The pandemic has caused the largest recorded peacetime shock to the global economy in modern history. World GDP is estimated by the IMF to have reduced by at least 3½ per cent in 2020 as governments imposed public health restrictions.

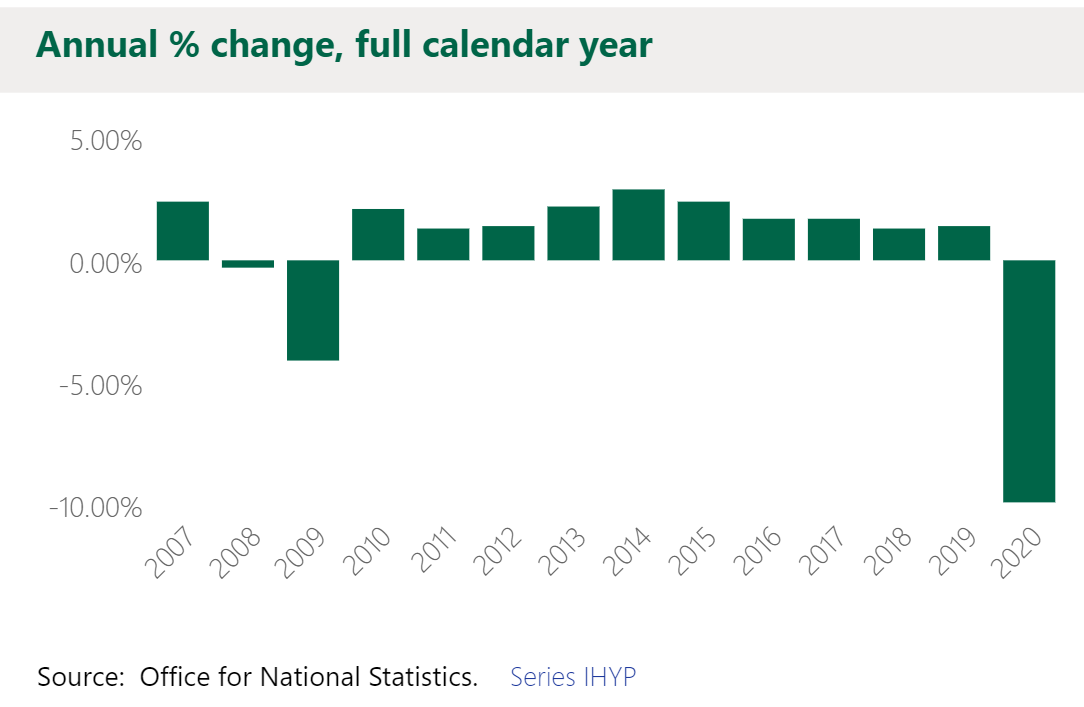

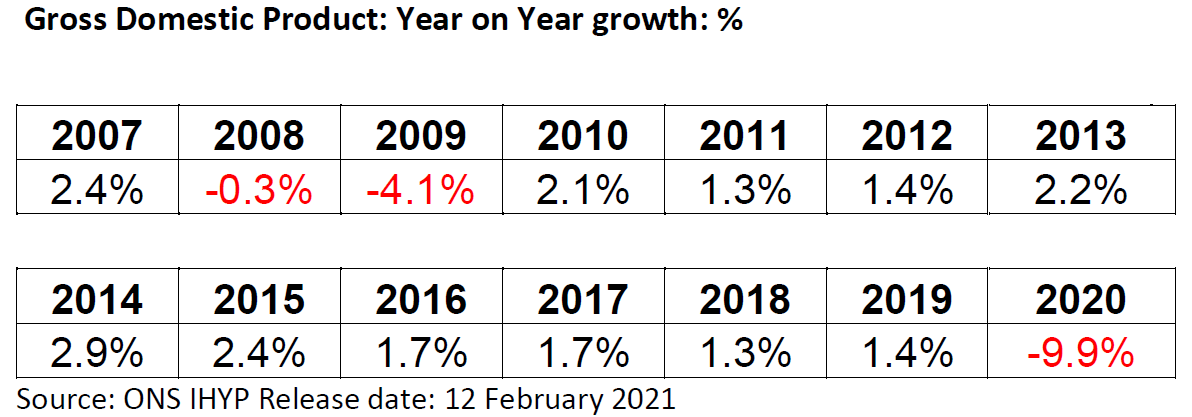

UK Economic Output - GDP

UK output lost in 2020 owing to the pandemic is estimated by the ONS as nearly 10% - in contrast to an increase of GDP of 1.4% in 2019 - although less than the OBR previously envisaged last November, when the OBR thought lost output might be about 11%.

Government’s pandemic-related support to public services, households, and businesses, projected to total nearly around £350 billion, has prevented an even greater fall in output, and diminished the potential effects on the capacity of the economy.

UK economic health dependent on vaccinations

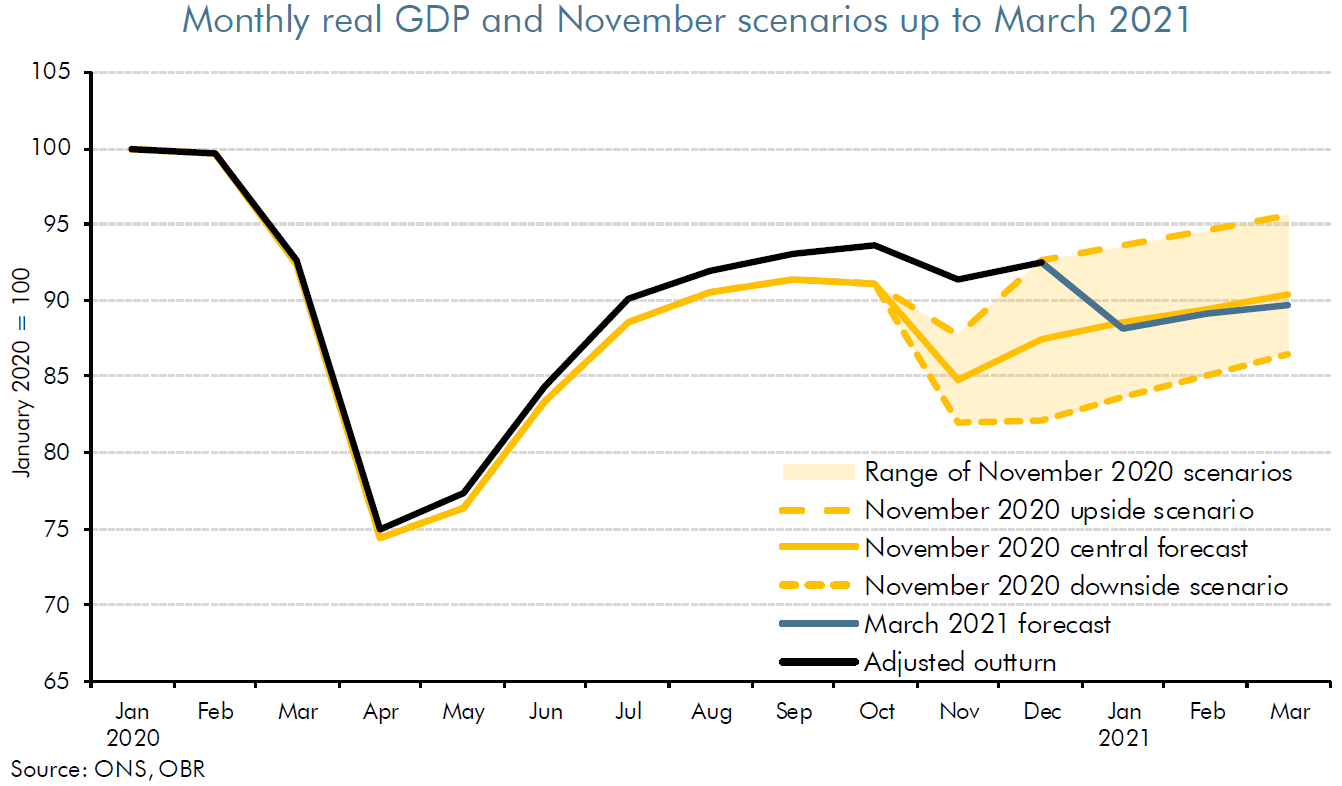

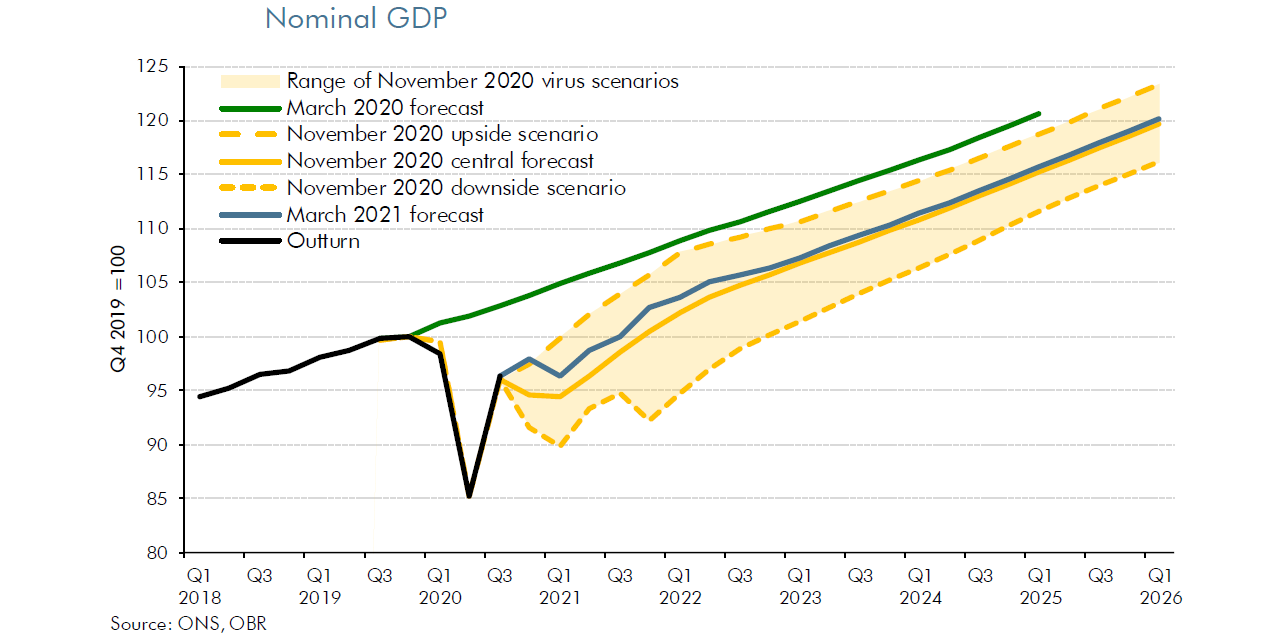

Since November 2020, the UK economy proved more resilient than expected with businesses adapting to the state of lockdown. The OBR previously gave three scenarios for the UK economy and public finances and these remain unchanged: An upside scenario from the OBR, with vaccination widely available in the spring, and a rapid return to relative normality by the end of 2021, with no long-term adverse effects: in the medium-term, negligible economic impact from the pandemic.

A ‘central’ forecast suggesting a slower, less effective vaccination programme, permitting a later return of normality and a 3% long-run loss of potential output in the UK economy.

The OBR’s downside scenario envisaged the continued spread of the coronavirus disease, with waves of transmission requiring periodic national lockdowns. The pandemic leaving permanent economic scarring of around 6% output lost. The possibility of continued risk of infection would see lasting changes in the conduct of life and emphasised the dependency of the UK economy on effective vaccination and control of the pandemic. Before the development of vaccines this downside scenario appeared the more realistic of the OBR’s three scenarios.

However, despite the pessimistic course of the pandemic, with the reintroduction of lockdowns across the UK in the autumn and winter, vaccination has proceeded much faster than predicted. More than 20 million doses have been administered and over one third of UK adults have received their first dose.

Effect on UK economic output

Output in November was only 8% below the pre-virus peak compared to 24% in April 2020, the economy managed to grow by 1% over the final quarter of 2020. Consequently, at the end of last year, output was broadly in line with the OBR’s upside scenario in part owing to Government spending and reflecting resilience of the private sector to lockdown.

Furthermore, the conclusion of a UK-EU Trade and Cooperation Agreement on 24 December partially resolved uncertainty concerning that future trading relationship. The OBR judge the terms of the agreement to be broadly in line with a typical free-trade agreement as assumed in their previous forecasts.

The OBR predict a faster economic recovery over the next two years led by an extension of the furlough scheme, rebounding levels of consumption boosted from households’ savings and much stronger business investment supported by generous tax incentives.

Expected medium term effect of pandemic

Nevertheless, the OBR believe that it will be some time before there is any clear evidence of the long-run economic cost of the pandemic. The OBR assume in projections a reduction in the medium to long-run potential output of around 3%. An estimate, they say that is comparable with other forecasters, which range between 1¾ and 6%, reflecting a diversity of views.

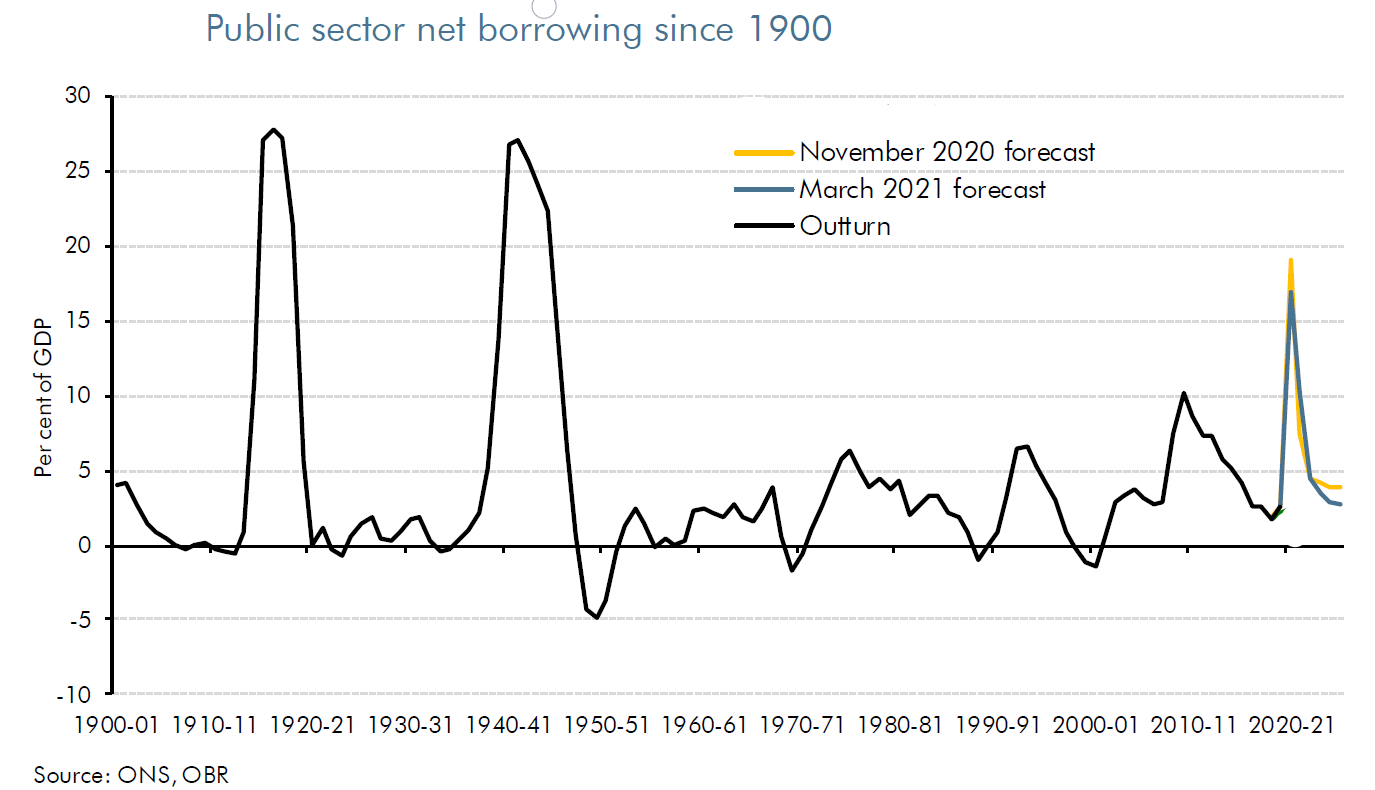

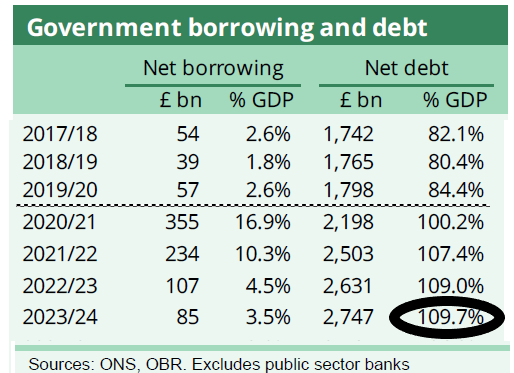

Resultant annual Government borrowing will reach a peacetime record of £355 billion (in scale around 17% of GDP) in 2020-21. With public sector current receipts of £786bn and total managed expenditure of £1,141bn, Government is borrowing just under one third of expenditure.

Corporate and personal tax rises play a key role in coming years by stabilising borrowing and the level of debt arising from the pandemic. The OBR still expect Government borrowing to reach a post-war high this financial year, leaving the headline stock of Net Debt, in terms of scale, at 110% of UK output (GDP) in 2023-24, the highest relative level since the 1950s.

Labour Market

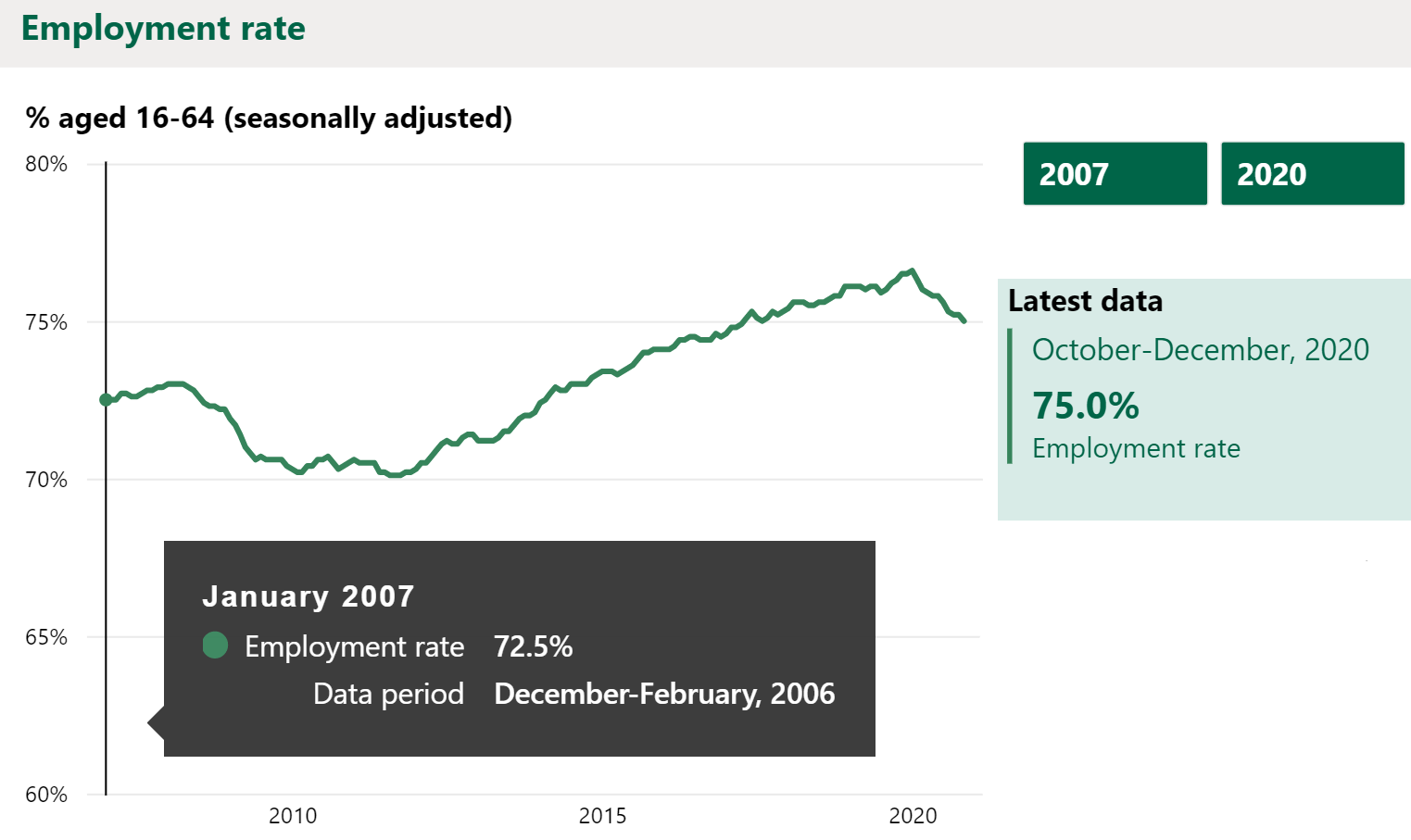

Just before the pandemic, the UK was enjoying the highest employment rate, with nearly 33 million people employed, and joint-lowest unemployment rate of 3.8% of the working age population, an estimated 1.29 million people (December 2019).

In November 2020, the OBR expected unemployment to rise by more than 800,000. The combined effect of Government’s measures and business adaptation has successfully ensured that unemployment is lower. According to the ONS 32.39 million people were in employment in October-December 2020, down 541,000 from the year before.

The extension of the furlough scheme to the end of September announced in this Budget should also ensure that the rise in the number of jobseekers is limited by a further 500,000. Inferring around 2¼ million people out of work at the end of 2021, the ‘peak’ the OBR project, and closer to their upside scenario.

Interest rate risks to the Budget

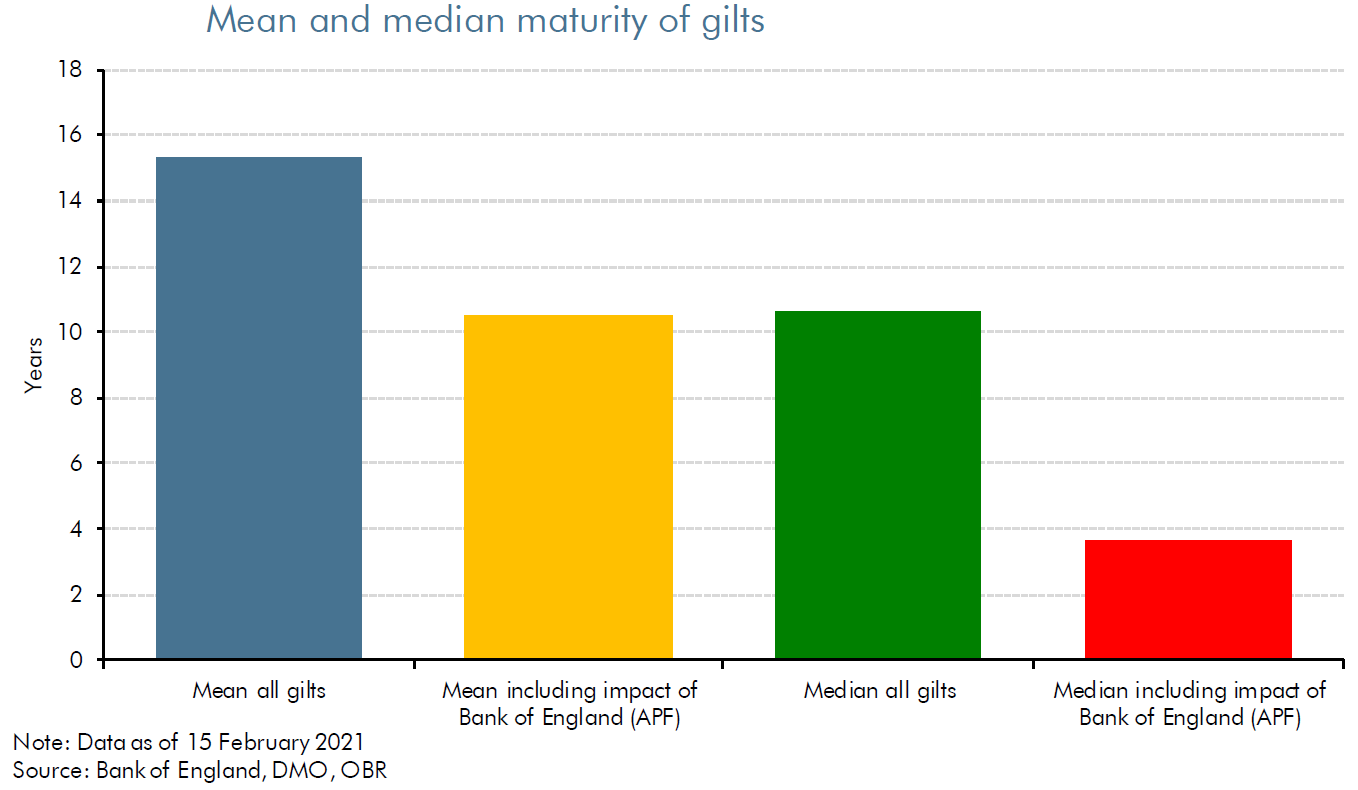

For more than a decade, successive Chancellors have used steadily declining interest rates on government debt to bolster Budget spending. This has allowed the average maturity of the stock of Net Debt, of the public sector as a whole, to be shortened considerably. Since the global financial crisis, this benefit has been magnified by the advent of quantitative easing. The effect of this policy is to dramatically increase the sensitivity of the Government’s cost of debt interest to changes in short-term interest rates.

The OBR estimate that if interest rates were to rise by just one percentage point, because investors demand a higher risk premium, for some reason, this would cost an additional £20 billion, the equivalent, of the additional corporation tax revenue to be raised by this 2021 Budget. Such a rise in interest rates would therefore make sustaining government debt, or borrowing to cover a deficit for that matter, much more difficult.

The OBR point out that, particularly in view of the scale of total historic public debt: “…debt interest may go from being a minor relief to a major headache for a Chancellor already trying to cope with the other post-pandemic pressures”.

The announcement of the future increase of corporation tax and personal tax reflects concerns about debt. Specifically, the cost of servicing the stock of debt, growing at nearly £1 billion a day. With interest costs of 10-year government bonds having recently risen by 0.3% to just under 0.8% the future room for manoeuvre for the Chancellor may be curtailed.

When Rishi Sunak was born, in 1980, inflation was around 17% with commensurate interest rates and government borrowing costs. With the advent and growth of quantitative easing’s ‘magic money tree’ then the threat of inflation appears to be taken seriously by the Chancellor, whose proposed tax increases are to limit exposure to this risk. But the planned ‘heavy tax burden’ — as a share of GDP, the highest in over 50 years — will dampen future economic growth.

Anthony Denny

10 March 2021