Spring 2023

Brighter economic and fiscal outlook since the European energy crisis

On Wednesday 15th March 2023, the Chancellor of the Exchequer, Jeremy Hunt, presented his Spring Budget to Parliament and the Office for Budget Responsibility (OBR) published their updated forecasts.

In the Spring Budget there was confirmation of the planned rise in the main rate of corporate tax from 19% to 25%, consumer support for households’ utility prices, being kept at £2,500 – rather than being raised to £3,000 – the Chancellor’s most notable announcement, cancelling the 20% increase, and a predictable delay of the 23% rise in fuel duty.

The surprise was measures intended to improve the supply of people in work, through an increase in free childcare, to help parents enter the workforce - costing about £5bn per year, and pension relief, with an increase in the annual tax relief allowance for contributions, and 100% capital allowances for companies. Each more costly than might have been predicted with around £22bn (0.8% of GDP) of ‘giveaways’ in 2023-24, more generous than many economists might have expected.

Last November’s un-budget statement tried to repair credibility in the wake of market turmoil after the mini-budget. This was following Russia’s invasion of Ukraine and continuing conflict that had precipitated a European energy crisis, which the OBR has identified as the most important economic development affecting their outlook. Since then, the ups and downs of gas prices have dominated prospects for most European countries. The price of wholesale gas has since fallen more sharply than the OBR had expected in their forecast in November 2022.

Markets now expect wholesale gas prices to more than halve from their quarterly peak of £3.50 a therm last year to £1.50 by the middle of this year, though market expectations remain more than twice their pre-pandemic level.

Retail energy prices are now expected to fall below the Government’s energy price guarantee. The decision in this Budget to extend that guarantee at £2,500 until the end of June 2023 means next quarter’s household energy bills will remain flat, rather than rising by 20 per cent as they would have done.

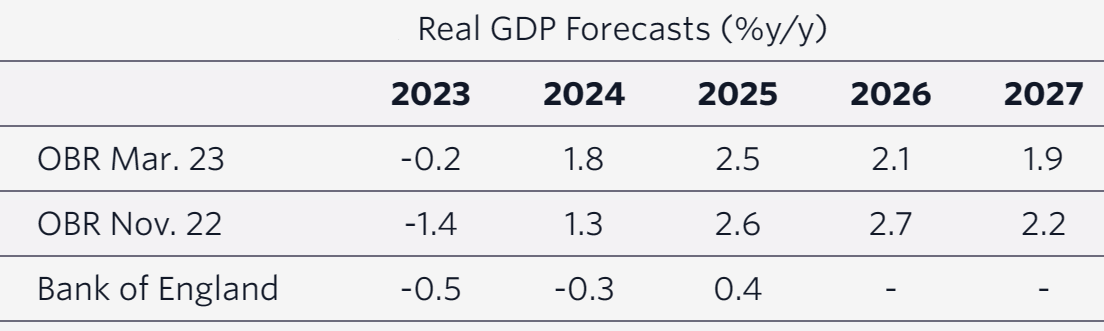

The consequence is that while the OBR is no longer forecasting a recession in this year (2023), and 2024 growth is revised higher by the OBR, expected growth of the UK economy in future years has been revised down. Overall, the UK economy is forecast by the OBR to be only slightly larger in 2027 relative to their November forecast.

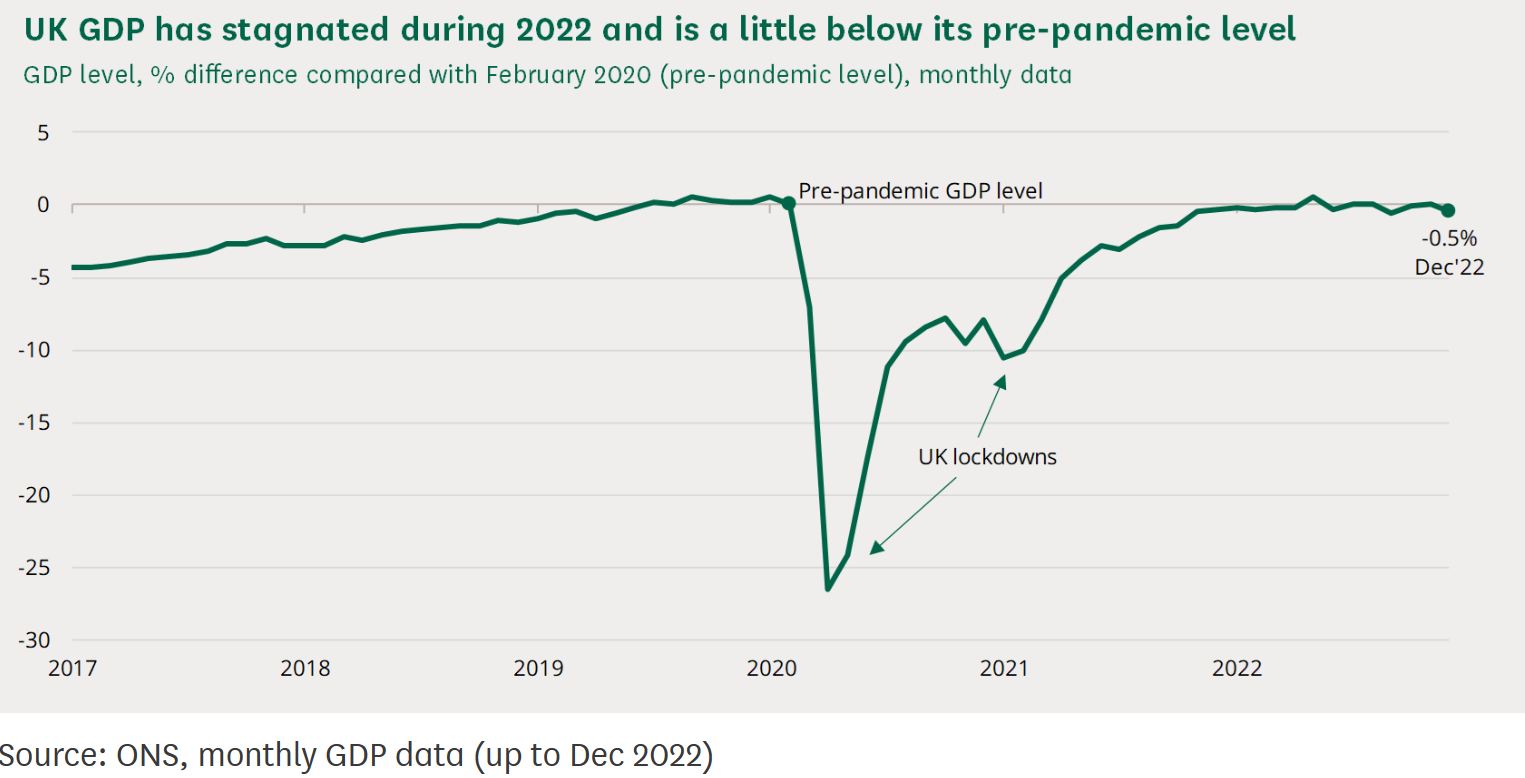

Gross Domestic Product – forecast output

The OBR now expect a ‘shorter and shallower downturn’ because of lower energy prices and expectations of interest rates, the OBR see Bank Rate peaking at 4.3%, reducing some of the near-term pressures on spending by households and businesses. From peak to trough, GDP is forecast as falling by just ½ per cent, much better than the 2% fall – for a recession lasting five quarters – of the OBR’s previous November forecast.

The UK’s economic output is expected to regain its pre-pandemic level by mid-2024. However, this forecast of the OBR is in marked contrast to that of the Bank of England’s pessimism:

In the medium-term, the OBR assumes core potential output growth of the UK economy is unchanged because of higher population growth, owing to higher net migration to the UK.

The OBR believe the ‘persistent structural weaknesses of the supply side’ of the UK economy have been exacerbated by recent shocks of the financial crisis, pandemic and the European energy crisis, owing to war in Ukraine. Of these weaknesses, key is the fall in labour market participation among older workers of around 500,000 people, since the pandemic, with over half of those aged between 50 and 64 and over half among those citing long-term sickness as their reason for being inactive. In their latest forecast, some of this decline in the domestic workforce is assumed to be made up for by inward net migration of 245,000 a year (an upward revision relative to November 2022’s forecast of 40,000 annually).

While assuming that around a quarter of the current economic inactivity (of the domestic workforce) is reversed by the middle of the decade, the total labour force would still be estimated by the OBR to be nearly 400,000 people smaller than that expected prior to the pandemic.

Nevertheless, their estimates for the size of the labour market and participation leaves the level of potential output 0.5% higher in 2027 relative to the OBR’s November forecast, well above the Bank of England’s forecast and serves to also explain why the OBR expects real GDP growth for the UK to be much stronger than the consensus of economists.

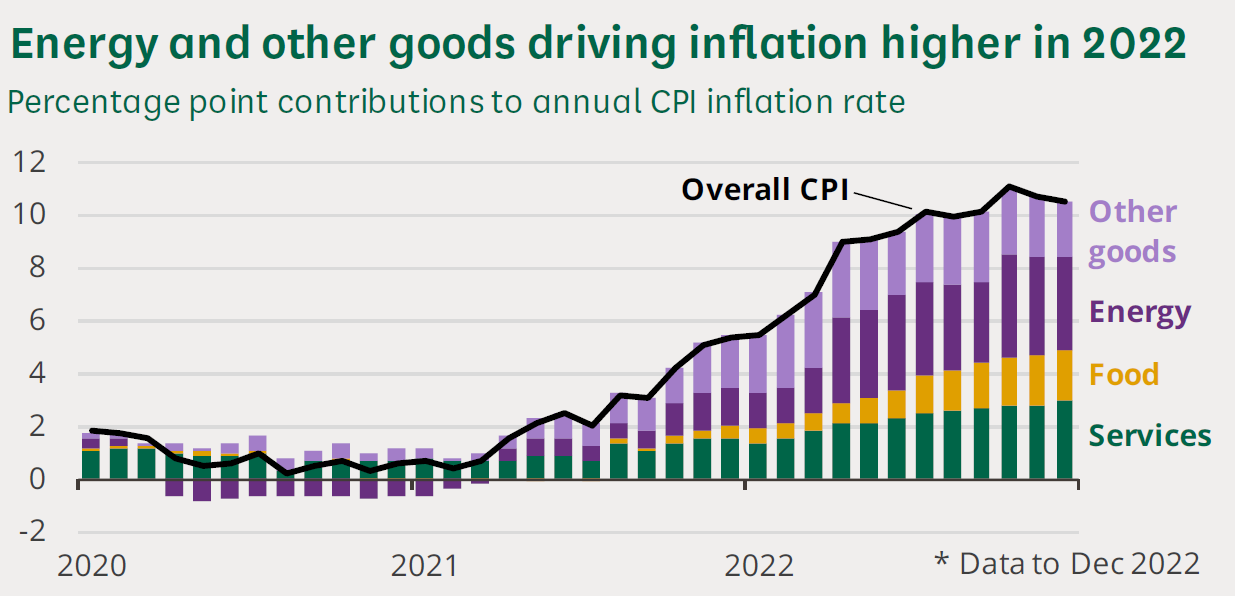

Living standards and inflation

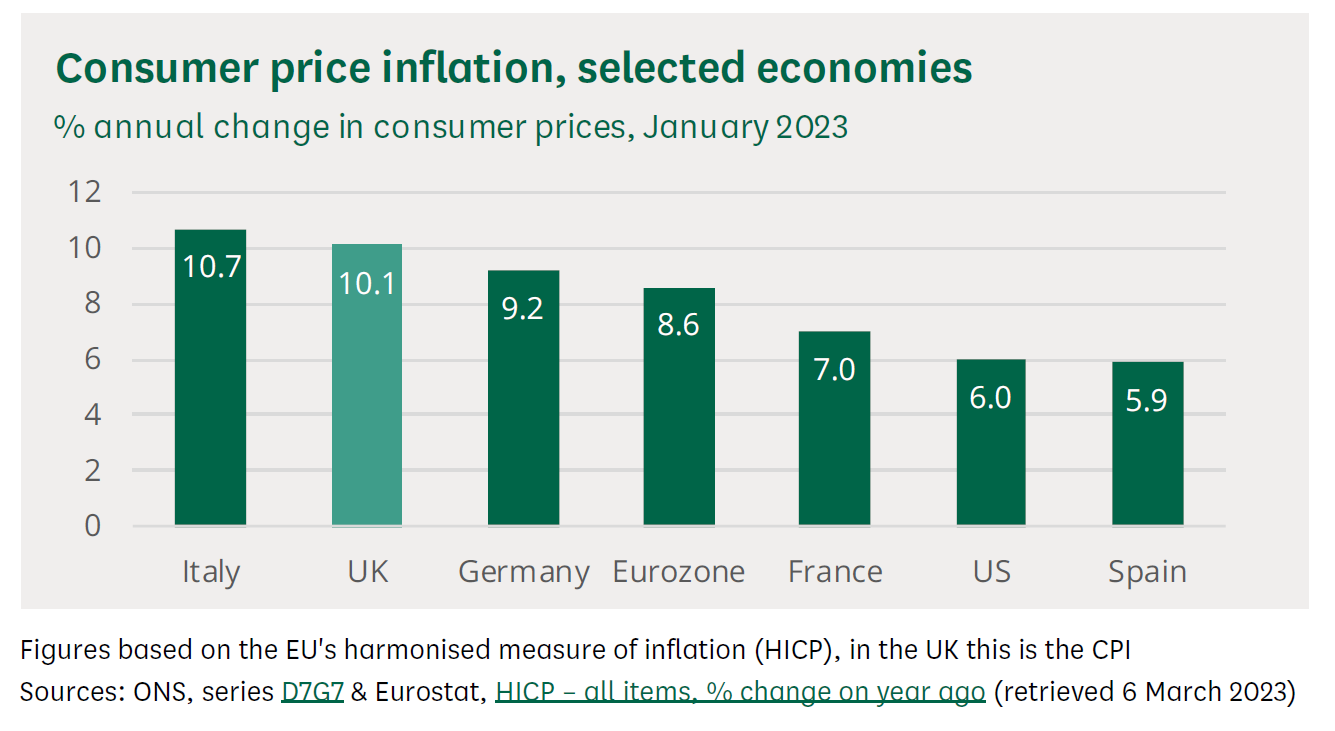

Consumer prices, as measured by the Consumer Prices Index (CPI), are believed by the OBR to have peaked at just over 11 per cent in October at the highest rate recorded since the data series began in 1997. The ONS estimated that CPI in October 2022 was higher than at any time since October 1981. Worryingly the CPI inflation rate was 10.4% in February 2023.

The RPI inflation rate was 13.8% in February 2023, up from 13.4% in January. October 2022’s figure of 14.2% was the RPI’s highest level since December 1980 – a more than 40-year high.

The OBR forecast a sharp fall in the rate of inflation to 3%, by the end of 2023, while acknowledging stronger ‘domestically generated inflation’ will have an impact on the UK economy. The modified view of the OBR is that real household disposable income, a measure of living standards, will still fall cumulatively, but by nearly 6% over the two financial years 2022 and 2023 rather than around 7% previously predicted. They predict this will be the largest two-year fall since records began in 1956-57.

The UK has rarely had two consecutive years of falling living standards. This would be only the third time since the mid-1950s that the statistical measurement of living standards has fallen for two consecutive fiscal years. The last time being in the aftermath of the global financial crisis and before that in the mid-1970s (1975-76 and 1976-77).

The fall in living standards mainly reflects the rise in the price of energy and other tradeable goods of which the UK is a net importer, resulting in inflation being above nominal wage growth. Despite this, as a positive effect on consumption of the UK economy, the OBR continue to expect households that can draw on savings to cushion the impact of the current and growing higher prices by using savings. This expectation of consumer and households’ behaviour represents another important difference of opinion with the Bank of England.

Potential output of the UK economy

The OBR have not changed their core assessment of the rate of medium-term potential growth, this remains unchanged at 1¾ per cent a year. What is altered is the level of potential output at the end of their forecast period, by ½%. The OBR had assumed that post-Brexit net migration would be below the pre-Brexit level (by 100,000 people plus). What has given surprise to them is that the post-Brexit regime for workers’ visas is more liberal than they had expected. Hence the upward revision to nearly ¼ million people annually.

The OBR consider that lower energy prices, despite lower potential capital investment and challenging worker participation, further assist the improvement. Albeit set against the difficult outlook for the public finances with taxation continuing to rise to its highest ever level (38% GDP).

Risks to the OBR’s reference narrative

What the OBR outlook cannot have factored in is the very recent crisis in US banking and the risk of contagion. A major risk to the public finances is that the economy fails to grow as much as the OBR expects if, for example, UK banks reprice their lending and/or reduce lending in the wake of the fallout from Silicon Valley Bank’s collapse. Furthermore, if inflation is higher, as many economists expect in the medium term, from domestically generated wage inflation for example, then nominal GDP growth would be higher in 2026 and 2027, possibly above 3½% annually.

An upward revision to nominal output would feed through to higher wages and nominal consumer spending, and company profits (outside the oil and gas sector). These are the three largest tax bases, underpinning around two-thirds of overall Government revenues. Nominal GDP is a key driver of the OBR’s forecasts, which are also conditioned on market expectations for interest rates, that would likely increase and put the Bank of England under pressure to further increase Bank Rate.

If interest rates were 1 percentage point higher – around half the rise in 10-year gilts over the past year and double the volatility over the past month leading to the Budget – Government annual borrowing in the final year of the forecast would be around £20 billion higher, the OBR compute. Higher inflation, while increasing the tax take through fiscal drag, would in turn put tight Government spending under further pressure.

Fiscal outlook

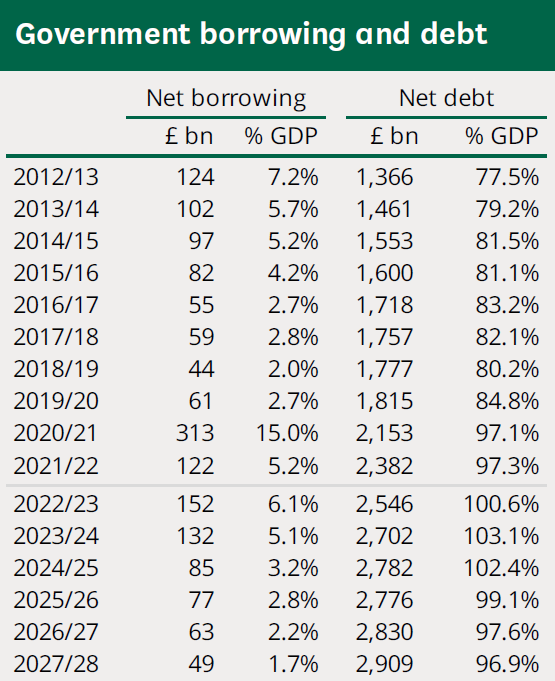

A surprise was the OBR’s new fiscal projections, which revealed an apparently lower path for public borrowing. The revised expectations of the OBR have provided a much-improved short-term outlook for the public finances. The OBR’s forecast changes for 2023-24 reduced borrowing (prior to policy changes announced) from £140bn to £113bn, giving a forecast windfall of £27bn; allowing for the Budget giveaways.

In fact, the Chancellor has spent around two-thirds of the improvement in the fiscal outlook on the measures announced in the Budget. Even so, borrowing is still set to be £32bn higher in 2026-27 than projected by the OBR this time last year - the headroom for reducing debt in five years’ time looks wafer thin (<£6bn).

Although stronger expectations for inflation might improve the prospects for underlying debt-to-GDP ratio in the short-term.

Even in the OBR’s central forecast, the OBR say it is harder for the Chancellor to deliver a falling path for the debt-to-GDP ratio in the medium term than it has been for any of his predecessors since the OBR was established in 2010.

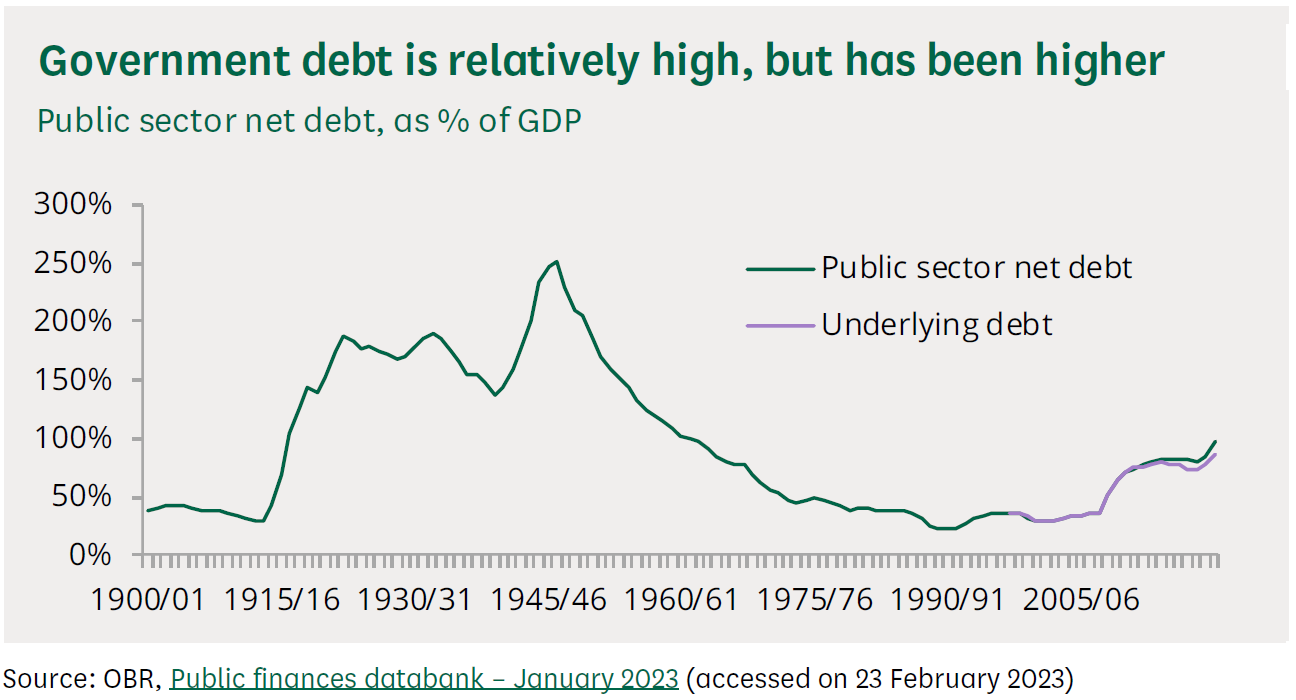

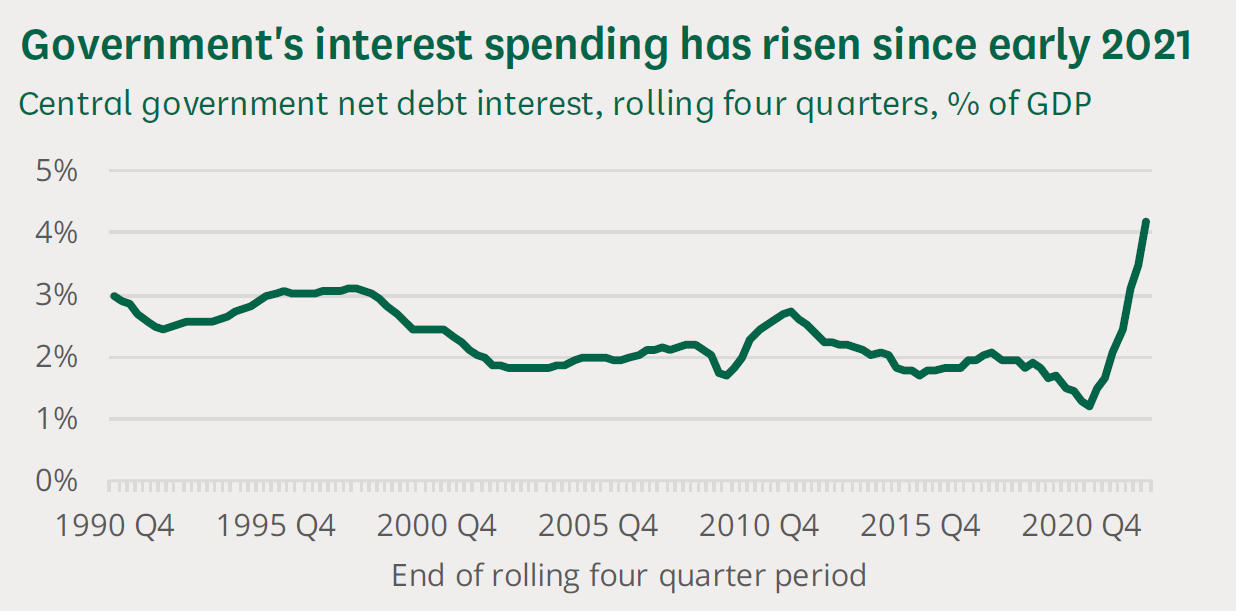

This is owing to a combination of subdued medium-term growth prospects, reflecting post-financial crisis weakness in productivity growth, which have been exacerbated by a series of further shocks in the form of the pandemic and rise in energy prices; the stock of Government debt that has been pushed to a 60-year high, largely as a result of those shocks; and interest rates on that higher stock of debt, which have tripled over the past year to their highest level in over a decade.

The OBR say it adds up to a situation where for any given debt-to-GDP ratio, less can be borrowed without that ratio rising; and for any given level of borrowing, more must be spent on debt interest, leaving less scope to finance other priorities.

Anthony Denny

15 March 2023